Getting more readers is the top priority for UK digital publishers in 2025 with subscriptions seen as the biggest revenue opportunity.

Some 85% of news leaders in senior positions at digital publishers told an Association of Online Publishers (AOP) survey that “growing our readership” was an important organisational priority currently.

In second place was developing new revenue streams through product innovation (80%) and in third place was increasing advertising revenues (79%).

The AOP outlook and priorities for 2025 survey received 120 responses, of which 78% came from senior leaders at digital publishers and 22% from solutions providers (answering about their publishing clients).

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r=0;r<e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

The report said publishers appear “very growth-focused” for 2025.

This was further backed up by 52% of respondents saying they planned to increase their content output, versus 10% who said they planned to decrease output. Metro’s director of audience Sofia Delgado has said the newsbrand increased traffic by 50% by producing 25% fewer pieces of content.

Four in ten said they planned to change the type of content they produce to attract more people.

In addition 61% said they had no plans to reduce their team size and just 4% said they intended to make cuts – although recruiting and retaining new talent fell from being a joint second priority in 2024 to the joint fourth this year.

In terms of growing revenues, two-thirds of respondents said they were exploring ways to leverage their audience engagement to increase advertiser revenues.

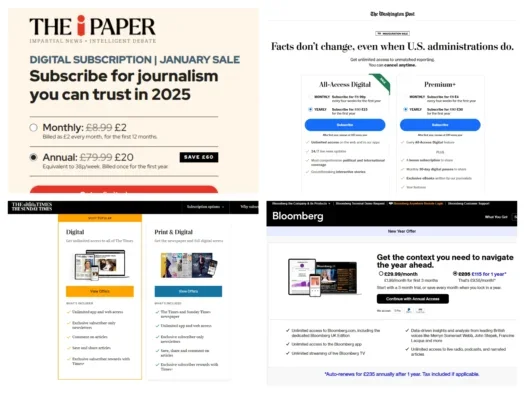

A third (34%) said they planned to introduce a paywall/subscription this year to boost revenues while 32% said they would trial a “freemium” model with some stories free to read and others behind a paywall – as The Sun has already launched this year and Mail Online did a year earlier.

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r=0;r<e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

Subscriptions were ranked as the area with the most potential for revenue growth over the next three years by 50% of publisher respondents (who could each choose up to five options).

Second-most potential for revenue growth was branded content and first-party data sales, both on 45%.

Bottom out of 12 options was licensing of content to benefit training of large language models (10%).

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r=0;r<e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

AOP said there was “no marked variation in priorities” between consumer and B2B focused publishers.

Another expected evolution is the move away from the open advertising marketplace: publishers said roughly 26% of their deals currently come from open marketplaces. They expected this to drop to 9% within three years.

Private marketplaces are expected to grow from 2% to account for 26% of ad deals.

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r=0;r<e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

On AI, publishers appear cautiously optimistic: they gave an average score of 6.5 out of ten (where zero was a negative impact and ten was positive) when assessing the impact of generative AI on their operations and processes, and a score of six when looking at the business models and future profitability of their business.

Asked what their organisation is doing to adapt or prepare for generative AI, many publishers gave a similar response to last year.

For example, 76% said they were exploring how to use generative AI to be more efficient last year, rising marginally to 77% for 2025.

The biggest difference was in having an editorial policy that prohibits the use of generative AI. Last year 26% of publishers said they had such a policy, but this dropped to 11% in the past year, showing an increased openness to using the tech in editorial workflows.

!function(){“use strict”;window.addEventListener(“message”,(function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r=0;r<e.length;r++)if(e[r].contentWindow===a.source){var i=a.data["datawrapper-height"][t]+"px";e[r].style.height=i}}}))}();

The post Growing readership is digital publishers’ top priority for 2025 – survey appeared first on Press Gazette.