Look, you may not be able to control the weather, or whether or not your flight is cancelled, but there is one simple thing travellers can do to *try* and make their summer holiday go as swimmingly as possible.

As Europe’s largest tour operator goes bust just as the holiday season kicks off, it’s perhaps no better time for holidaymakers to protect their hard-earned summer plans in advance.

To take the grunt work out of such an endeavour, the travel insurance experts at Quotezone.co.uk have taken a look at travel delays, cancellations and even provider collapses to help London holidaymakers get the upper hand on travel hiccups.

The short of it is, financial and legal protections for travellers differ greatly depending on what has been booked and where the purchase was made – so Quotezone has compiled reminders on the protections offered by Air Travel Organisers’ Licence (ATOL) and other relevant regulations.

Nine airlines filed for bankruptcy last year, as the travel industry still tries to find its feet (or, rather, wings) in the Covid aftermath – one of which was London favourite Flybe.

ATOL is a financial protection scheme managed by the Civil Aviation Authority (CAA) in the UK and is designed to protect consumers who’ve purchased package holidays or flights from UK-based travel companies in the event that the company ceases trading, or goes ‘bust’.

However, holidaymakers’ level of protection varies depending on whether they’ve booked a package holiday or made their own arrangements.

Flight delays and cancellations also play a major part in ruining holidays and, especially seeing as most travellers can probably relate, is something London holidaymakers must make sure they have protection for.

Of the London airports, 1,080 flight cancellations were reported in the latest data from the Civil Aviation Authority – the sample was taken during the month of April 2024 – with 434 flights reporting significant delays between 2-3 hours or more. At Heathrow alone, 643 flights were cancelled.

If the flight is cancelled, passengers legally have the right to request a full refund from the airline, or a replacement flight which will allow travellers to get to their final destination.

How to save on travel insurance

Metro Finance has teamed up with Quotezone to help readers save money on their travel insurance.

Quotezone.co.uk compare up to 35 providers and 97% of reviewers recommend them.

For delays of three hours or more, travellers can also request compensation directly from the airline. However, the airline will rarely give out compensation if a delay was caused due to reasons beyond their control – such as adverse weather conditions.

Most standard travel insurance policies cover compensation for cancellation or curtailment if the traveller has to cancel or cut short the holiday for reasons out of their control.

It will also normally cover them for missed or delayed departure, covering any expenses they may face if the flight is postponed or if they miss it through no fault of their own.

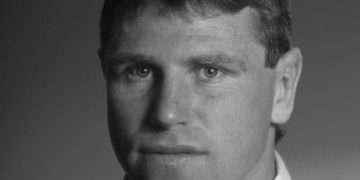

CEO and travel insurance expert at Quotezone, Greg Wilson said: ‘As holiday season approaches and holiday itineraries are finalised, we wanted to remind Londoners of their rights in case of travel delays, cancellations or even bankrupt holiday partners.

‘With the current financial struggles in the UK, 15% of holidaymakers are searching for cheaper deals online and booking with sites and tour operators that aren’t as well-known to help find savings.*’

Wilson added: ‘This makes it crucial that travellers do additional research before booking, ensuring they are protected by recognised travelling bodies and have a travel insurance policy in place as soon as they make the booking.

‘Holidaymakers need to make sure they look for the ATOL logo and check the specifics of the travel insurance, for example, if the flights are booked directly with the airline, it’s sensible to add airline failure or end supplier failure insurance, for protection in case they go bust.’

How can London travellers protect themselves before holiday mayhem hits?

Find out if your booking is ATOL protected

ATOL protection applies to most air trips abroad that are booked with UK travel companies. If you are covered by ATOL, your travel company should have given you an ATOL certificate when you booked. Under the ATOL scheme, if a firm goes out of business and you can no longer take your trip, your booking will be refunded. If it happens when you are abroad, don’t panic. You will be able to finish your holiday and fly home as you originally planned.

Look at package holidays

A package holiday is when you book more than one part of your holiday through the same travel agent or website – for example, your hotel and plane tickets. Fortunately, package holidays have both financial and legal protection, and the Package Travel and Linked Travel Arrangements Regulations 2018 require organisers of package holidays to provide protection for your money and to bring you home if necessary. This means that all companies selling package holidays must offer the same level of protection. This protection will prevent you from losing money and will also help you sort out any practical problems should they or the airline you’re flying with go bust.

Consider linked travel arrangements

A linked travel arrangement is when you buy one part of your holiday and then are prompted to buy another part via a click-through within 24 hours. For example, if you buy a flight and then are prompted to purchase car hire through the same website. Linked travel arrangements aren’t covered by ATOL but they do benefit from other insolvency protections. A linked travel arrangement only has financial protection – and this is at a lower level than if you bought a package holiday. The financial protection provides some cover if the company that arranged your linked travel arrangement goes out of business. As there is no legal protection covering the whole linked travel arrangement, any complaints about the provision of the services must be directed to the service providers themselves.

Think about independent travel

The Civil Aviation Regulations 2012 (Air Travel Organisers’ Licensing) are overseen by the CAA and require tour operators who sell flight-only arrangements to provide protection for your money and to bring you home if necessary. However, this protection does not apply to flights that are bought directly from an airline. If you book a flight directly with an airline, unfortunately you will not be covered by ATOL. This means that if the airline you booked with goes bust while you’re abroad, you will need to book a return flight with another airline. However, if you’ve scheduled airline failure or end supplier failure insurance added to your travel insurance policy, you should be able to get any additional flight or hotel expenses refunded.

Get travel insurance – but check the fine print

Not all travel insurance policies include insolvency protection either, so it’s crucial to check the specifics of your policy. Insolvency protection ensures that if your travel provider goes bust, your policy will cover things like refunds for paid expenses, repatriation costs, and alternative travel arrangements. Travel insurance comparison can help holidaymakers find real savings, by comparing travel insurance quotes for annual versus single trip policies, there could be savings to be found. Also review worldwide versus travel insurance for Europe to ensure all your destinations booked throughout the year are accounted for on the cheapest possible policy.

Take advantage of credit card bookings

If you have paid for your holiday with a credit card, you may have additional protections under Section 75 of the Consumer Credit Act. This legislation makes your credit card issuer jointly liable if something goes wrong, offering another avenue for refunds.

For other helpful holiday preparation, read European holiday tax increases before jetting off.

*Quotezone.co.uk’s findings are based on a randomised survey of 1,000 respondents across the UK during June 2024, which represents a margin of error of approximately 5% at a 95% confidence level.